The financial technology landscape continues evolving rapidly. Embedded Finance vs Banking as a Service represents two transformative approaches reshaping financial services. Businesses must understand these models to leverage their full potential.

This comprehensive guide explores Embedded Finance vs Banking as a Service in detail. We’ll examine their definitions, technical foundations, business applications, and future trends. You’ll gain clear insights to determine which solution fits your organization’s needs.

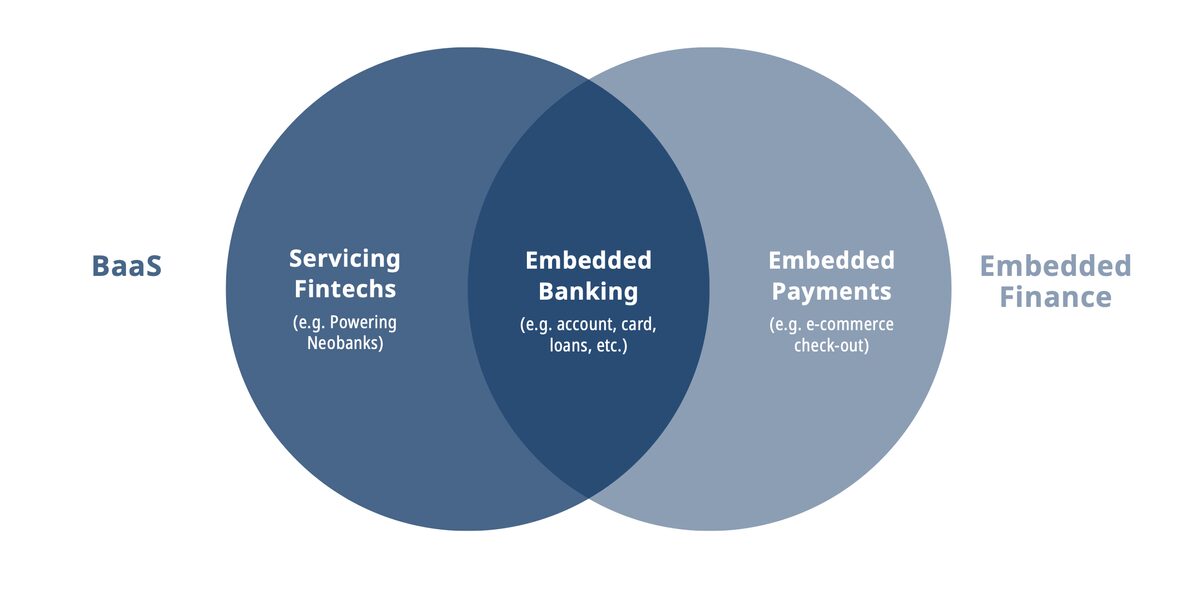

Both models democratize financial services but through different approaches. Embedded Finance integrates banking into non-financial platforms. Banking as a Service provides the infrastructure enabling such integrations.

Understanding Embedded Finance

Embedded Finance represents the seamless integration of financial services into non-financial platforms. Retailers, tech companies, and service providers embed banking features directly into their customer experiences.

This model eliminates friction in financial transactions. Customers access services contextually without switching applications. Common examples include buy-now-pay-later at checkout or insurance offers during travel bookings.

Embedded Finance creates new revenue streams for businesses. Platforms earn commissions on financial products sold. Customer engagement increases through convenient, value-added services.

The approach requires partnerships between fintechs and traditional financial institutions. Regulatory compliance remains critical despite the non-financial facade. Security and data protection standards must match traditional banking.

Exploring Banking as a Service (BaaS)

Banking as a Service provides the foundational infrastructure for Embedded Finance. BaaS platforms expose banking capabilities through APIs to third-party developers.

Licensed financial institutions power these services behind the scenes. They handle regulatory compliance, risk management, and core processing. Partner companies focus on customer experience and distribution.

BaaS enables rapid financial product deployment. Businesses can launch payment systems, accounts, or lending products quickly. The model reduces development costs and time-to-market significantly.

Popular BaaS offerings include card issuing, account aggregation, and payment processing. These modular services allow businesses to assemble customized financial solutions.

Key Differences: Embedded Finance vs Banking as a Service

While related, Embedded Finance vs Banking as Service differ fundamentally in several aspects. Understanding these distinctions informs better technology decisions.

Service Ownership and Control

Embedded Finance puts customer-facing brands in control. The host platform owns the user experience and relationship. Financial providers operate invisibly in the background.

Banking as a Service keeps financial institutions central. They maintain control over compliance and risk management. Partner companies integrate banking features as secondary offerings.

User Experience Design

Embedded Finance creates seamless, contextual experiences. Financial services blend naturally into existing user journeys. The integration feels native rather than bolted-on.

Banking as a Service requires explicit financial interfaces. While customizable, these maintain distinct banking characteristics. The experience often feels more transactional than embedded solutions.

Implementation Complexity

Embedded Finance demands deep platform integration. Businesses must rebuild user flows around financial features. The technical and design challenges are substantial.

Banking as a Service offers plug-and-play functionality. Pre-built APIs accelerate deployment. However, customization options are more limited compared to embedded approaches.

Regulatory Responsibilities

Embedded Finance providers assume significant compliance duties. They must ensure financial regulations are met despite non-financial branding. Oversight extends across customer interactions.

Banking as a Service keeps compliance with licensed providers. Partner companies focus on distribution rather than regulation. This reduces liability but also limits control.

Advantages of Embedded Finance

Embedded Finance offers compelling benefits for businesses and consumers alike. These advantages explain its rapid market adoption.

Enhanced Customer Experience

Financial services appear exactly when needed most. Customers complete transactions without switching contexts. This convenience drives higher conversion and satisfaction.

Increased Revenue Opportunities

Platforms earn commissions on financial products sold. New monetization channels complement core offerings. Higher customer lifetime values result from expanded service portfolios.

Deeper Customer Insights

Integrated financial data reveals spending behaviors and needs. Platforms gain holistic views of customer finances. These insights enable hyper-personalized product recommendations.

Competitive Differentiation

Embedded Finance creates unique value propositions. Platforms offering financial services stand apart from competitors. The approach builds more comprehensive ecosystem offerings.

Benefits of Banking as a Service

Banking as a Service delivers distinct advantages for financial innovators. These strengths make BaaS ideal for certain business models.

Rapid Market Entry

Pre-built APIs slash development timelines. Businesses launch financial products in weeks rather than years. Time-to-market advantages are substantial versus building from scratch.

Reduced Regulatory Burden

Licensed partners handle compliance complexities. Businesses avoid costly banking licenses and oversight. Risk management resides with experienced financial institutions.

Lower Capital Requirements

BaaS eliminates infrastructure investment needs. No core banking systems or processing networks are required. Operating costs align directly with usage and scale.

Proven Financial Infrastructure

Partners leverage battle-tested banking platforms. Reliability and security meet industry standards. Performance scales with demand through established systems.

Implementation Challenges

Both models present unique hurdles that organizations must navigate carefully.

Embedded Finance Challenges

Technical integration demands significant development resources. Maintaining seamless experiences across updates proves complex. Regulatory compliance requires specialized expertise many non-financial firms lack.

Banking as a Service Challenges

Customization limitations may constrain product visions. Dependency on provider roadmaps creates strategic risks. Commoditized offerings make differentiation difficult in crowded markets.

Technology Foundations

Embedded Finance vs Banking as a Service share common technological underpinnings. These components enable both models to function effectively.

API Ecosystems

Robust APIs connect disparate systems securely. Standardized protocols ensure reliable interoperability. Comprehensive documentation accelerates developer adoption.

Cloud Infrastructure

Scalable cloud platforms handle variable transaction volumes. Geographic distribution ensures low-latency performance. Redundant architectures guarantee high availability.

Data Security Frameworks

Encryption protects sensitive financial data. Tokenization secures payment credentials. Continuous monitoring detects and prevents fraudulent activities.

Identity Verification

Biometric authentication confirms user identities. Digital identity solutions streamline onboarding. Risk-based authentication balances security with convenience.

Industry Applications

Various sectors leverage these models differently based on specific needs.

Retail and E-Commerce

Embedded Finance dominates with instant credit and payments. BaaS powers back-end processing for marketplaces. Both reduce checkout friction and increase conversion.

Travel and Hospitality

Insurance and currency services embed seamlessly. BaaS enables cross-border payment aggregation. Integrated offerings improve customer experiences during trips.

Healthcare

Embedded payment plans ease medical expenses. BaaS facilitates health savings account management. Financial stress reduces through contextual solutions.

Gig Economy

Instant payouts and micro-loans support workers. BaaS platforms handle high-volume small transactions. Financial tools integrate directly with earning apps.

Future Trends

Several developments will shape the evolution of both models.

Hyper-Personalization

AI will enable real-time product customization. Behavioral data will inform contextual financial offers. Predictive analytics will anticipate needs before expression.

Decentralized Finance Integration

Blockchain-based services may supplement traditional offerings. Smart contracts could automate financial agreements. Digital assets might become embeddable options.

Expanded Regulation

New frameworks will address embedded financial risks. Consumer protection standards will evolve. Compliance automation will become essential for scale.

Industry Specialization

Vertical-specific financial products will emerge. Healthcare, education, and housing will develop tailored solutions. Niche offerings will outperform generic ones.

Choosing the Right Model

Several factors determine whether Embedded Finance vs Banking as a Service fits better.

When to Choose Embedded Finance

Deep customer relationships already exist. Financial services represent core strategic differentiators. Resources support complex integration and compliance needs.

When to Choose Banking as a Service

Speed-to-market is critical. Financial expertise is limited internally. Customization needs are moderate rather than extensive.

Conclusion

Embedded Finance vs Banking as a Service represents complementary innovations transforming financial services. Embedded solutions focus on customer experience while BaaS provides enabling infrastructure.

Businesses must evaluate their capabilities, resources, and strategic goals. The right choice depends on desired control, customization needs, and implementation timelines. Both models will continue evolving as financial services become increasingly contextual.

Progressive Robot helps organizations navigate these complex decisions. Our fintech experts design and implement tailored solutions for both models. Contact us to discuss your specific requirements and opportunities.