The insurance industry is rapidly going digital. More companies now recognize the value of having their own insurance app to serve customers better. These mobile solutions transform how people buy and manage policies.

This guide explains everything about insurance app development. You’ll learn about different app types, must-have features, and the step-by-step creation process. We’ll also explore how this app can benefit both your company and your customers.

Creating a successful insurance app requires careful planning. You need to understand user needs, choose the right features, and ensure top security. Follow this roadmap to build an app that stands out in the competitive insurance market.

What Is an Insurance App?

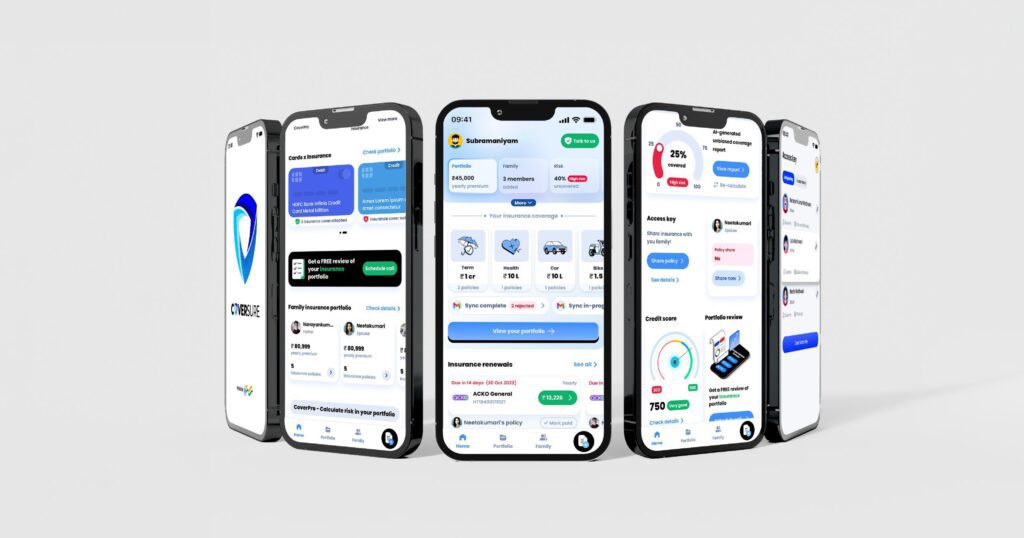

An insurance app is mobile software that helps users manage their insurance needs. It serves as a digital platform between insurers and policyholders. Customers can access it anytime from their smartphones or tablets.

These apps typically let users view policies, file claims, and make payments. Some offer additional services like risk assessment or emergency assistance. A good insurance app makes complex insurance processes simple and convenient.

It benefits companies by reducing paperwork and calls to support centers. They also provide valuable customer data that helps improve services. For users, they offer 24/7 access to insurance services from anywhere.

The best insurance apps combine functionality with excellent user experience. They should be intuitive, fast, and secure. This builds trust and encourages customers to use the app regularly.

Types of Insurance Apps

Different insurance apps serve different purposes. Choosing the right type depends on your business goals and target audience. Here are the main categories available today.

General Insurance Apps

General insurance apps cover multiple insurance types in one platform. They might include auto, home, health, and travel insurance options. These apps appeal to users who want all their policies in one place.

Such apps often feature comparison tools. Users can view different policies side by side. This helps them choose the best coverage for their needs and budget.

Specialized Insurance Apps

Specialized insurance apps focus on one insurance type. Examples include apps just for life insurance or pet insurance. These cater to specific customer needs with tailored features.

A car insurance app might offer driving behavior tracking. A health insurance app could include fitness challenges. Specialization allows for deeper, more relevant features.

Claims Processing Apps

Claims apps streamline the often stressful claims process. Users can submit claims, upload documents, and track progress. Some even use AI to assess damage photos instantly.

These apps reduce processing time and improve customer satisfaction. They also help insurers detect fraudulent claims more effectively.

Policy Management Apps

Policy management apps help users organize their existing coverage. Customers can view policy details, check renewal dates, and update information. Some allow digital signing of documents.

These apps reduce administrative work for insurers. They also help prevent lapses in coverage due to missed renewals.

Benefits of Building a Custom Insurance App

A custom app offers advantages over generic solutions. It can be designed specifically for your business and customers. Here are the key benefits of going custom.

First, branding becomes stronger with a custom app. You control every visual element and user experience detail. This makes your app instantly recognizable to customers.

Second, custom apps fit your exact business processes. They can integrate with your existing systems seamlessly. Off-the-shelf solutions often require compromising your workflow.

Third, security improves with custom development. You can implement the exact security measures your company requires. This is crucial for handling sensitive customer data.

Fourth, custom apps scale as your business grows. You can add new features and insurance products easily. There are no limitations imposed by third-party software.

Finally, custom apps provide valuable data insights. You can track exactly how customers use your services. This information helps improve products and marketing strategies.

Essential Features for Insurance Apps

A successful app needs certain core features. These ensure users can complete all necessary tasks easily. Here are the must-have components for your app.

User Registration and Profiles

Secure registration lets users create accounts quickly. Social media login options improve convenience. Profile management allows customers to update their details anytime.

Policy Purchase and Management

Users should be able to browse and buy policies in the app. Policy management features let them view coverage details and make changes. Renewal reminders prevent accidental lapses.

Claims Processing

Digital claims submission saves time for everyone. Users can upload photos and documents directly. Status tracking keeps customers informed throughout the process.

Document Storage

Secure document storage is essential. Users need to access policy documents and receipts anytime. Cloud integration ensures files are available across devices.

Secure Payments

Integrated payment gateways handle premiums and claims payouts. Multiple payment options improve convenience. Strong encryption protects financial transactions.

Customer Support

Live chat connects users with support agents quickly. FAQ sections answer common questions. Some apps include virtual assistants for basic queries.

Notifications

Push notifications remind users about payments and renewals. They can also alert about claim updates or policy changes. Personalized notifications improve engagement.

Insurance App Development Process

Creating this app involves several key steps. Following this process ensures a high-quality result that meets your business needs.

Planning and Research

First, define your app’s purpose and target audience. Research competitor apps to identify best practices. Create detailed specifications for developers to follow.

Design Phase

Designers create wireframes showing the app’s layout. Then they develop the full user interface with your branding. User experience testing ensures the design works well.

Development Stage

Developers build the app’s backend systems first. This includes databases and server infrastructure. Then they create the frontend that users will see and interact with.

Testing and Quality Assurance

Testers check every feature thoroughly. They look for bugs, performance issues, and security vulnerabilities. User testing gathers feedback from real people.

Launch and Deployment

The app gets published to app stores after testing. Marketing campaigns help drive downloads. Staff training ensures your team can support app users effectively.

Maintenance and Updates

Regular updates keep the app working smoothly. New features get added based on user feedback. Performance monitoring identifies areas for improvement.

Challenges in Insurance App Development

Building this app comes with certain challenges. Being aware of these helps you prepare solutions in advance.

Security is the top concern for insurance apps. They handle sensitive personal and financial data. Strong encryption and authentication methods are essential.

Compliance with regulations is another challenge. Insurance apps must follow industry rules and data protection laws. Legal experts should review the app before launch.

Integration with legacy systems can be difficult. Many insurers use older software that wasn’t designed for mobile connectivity. APIs and middleware help bridge these gaps.

User adoption presents another hurdle. Some customers may hesitate to use digital channels. Clear onboarding and education improve adoption rates over time.

Future Trends in Insurance Apps

Insurance apps continue evolving with new technologies. Several trends will shape their development in coming years.

AI chatbots will handle more customer service tasks. They’ll answer questions and guide users through complex processes. This reduces wait times and operational costs.

Blockchain technology may verify claims automatically. Smart contracts could process payouts when certain conditions are met. This increases transparency and speed.

Wearable integration will grow for health insurance apps. Data from fitness trackers could influence premiums and rewards. This encourages healthier lifestyles.

Augmented reality might help assess property damage. Users could scan damage with their phone camera. The app would estimate repair costs instantly.

Conclusion

This app can transform how your company serves customers. It makes insurance processes faster, easier, and more accessible. The right app strengthens customer relationships and boosts efficiency.

Building a successful insurance app requires expertise. You need developers who understand both technology and the insurance industry. Their knowledge ensures your app meets all requirements.

Progressive Robot specializes in insurance app development. Our team creates secure, user-friendly apps tailored to your business. Contact us today to discuss your insurance app project.