In recent years, the financial services industry has changed a lot because of new technology and what customers expect. One of the biggest reasons for this change is the rise of Open Banking and the API economy. These two ideas are making finance more open, innovative, and customer-friendly.

In this article, we will see how Open Banking and API economy are reshaping finance by working with fintech companies. We will also look at their key parts, challenges, success stories, and future trends.

What Are Open Banking APIs?

Open Banking means banks share customer data with outside developers in a safe way. This helps create new apps and services that make banking better. APIs, or Application Programming Interfaces, are the tools that allow this sharing to happen smoothly.

APIs act like bridges between different systems. They let apps talk to each other and exchange information without problems. Because of this, fintech companies can build useful tools that work with bank data. For example, budgeting apps can show all your transactions in one place.

The Open Banking and API economy model is growing fast. Many banks and startups now use it to offer better services. Customers get more choices, and banks can stay competitive in a digital world.

Key Components of Open Banking and API Economy

The success of Open Banking and API economy depends on several important parts working together. These include rules, technology, security, and data management.

Regulatory Frameworks

Governments and financial authorities set rules for Open Banking. These rules make sure banks share data safely and fairly. For example, in Europe, PSD2 (Payment Services Directive 2) requires banks to open their data to approved third parties.

These regulations protect customers while encouraging competition. Banks must follow strict guidelines to keep data safe. At the same time, fintech companies get a fair chance to innovate. Without these rules, Open Banking and API economy would not work as well.

API Standards and Specifications

APIs must follow certain standards to work properly. Common standards include RESTful APIs, OAuth 2.0, and OpenID Connect. These make sure APIs are secure, fast, and easy to use.

Standardized APIs help different systems connect without errors. They also ensure that apps can grow as more users join. Without these standards, Open Banking would face many technical problems.

Security Measures and Protocols

Security is a top priority in Open Banking and API economy. Banks and fintech companies use strong encryption, authentication, and secure data-sharing methods. This keeps customer information safe from hackers and fraud.

APIs must also follow strict security rules. For example, they should only allow access to authorized apps. Multi-factor authentication adds another layer of safety. These steps help build trust in Open Banking services.

Data Governance Principles

Clear rules for data sharing are essential. Customers must know how their data is used and give permission first. Open Banking follows principles like transparency, consent management, and data accuracy.

Good data governance prevents misuse of information. It also ensures compliance with privacy laws like GDPR. When customers trust how their data is handled, they are more likely to use Open Banking services.

Challenges and Considerations of Bank API Integration

While Open Banking and API economy offer many benefits, they also come with challenges. Banks and fintech companies must solve these issues to succeed.

Data Privacy and Security Concerns

Keeping customer data safe is a major challenge. Cyberattacks and data breaches can harm trust in Open Banking. Banks must invest in strong security tools and train employees to prevent risks.

APIs must be tested regularly for weaknesses. Hackers often target financial data, so constant monitoring is needed. Strong encryption and secure login methods help reduce these risks.

Compliance with Regulatory Requirements

Different countries have different Open Banking laws. Following all these rules can be difficult for global companies. For example, Europe has PSD2, while other regions have their own regulations.

Banks must spend time and money to meet these rules. They also need legal experts to stay updated on changes. Non-compliance can lead to fines and loss of customer trust.

Technical Complexities

Building and maintaining APIs is not easy. Developers must ensure APIs work smoothly across different devices and systems. They also need to update APIs without causing errors for users.

Managing high traffic is another challenge. If too many users access an API at once, it may slow down or crash. Banks must design APIs that can handle large volumes of data efficiently.

Interoperability Issues

Not all APIs work the same way. Differences in data formats and security protocols can cause problems. For Open Banking to succeed, all systems must communicate smoothly.

Industry-wide standards can help solve this. When banks and fintech companies agree on common rules, integration becomes easier. This leads to better services for customers.

People’s Mistrust

Many customers still worry about sharing their bank data. They fear fraud or misuse of their information. Banks must educate users on how Open Banking keeps their data safe.

Transparency is key to gaining trust. Customers should know exactly how their data is used. Clear communication and strong security features can help reduce fears.

Use Cases and Success Stories of Open Banking APIs

Open Banking and API economy have already led to many success stories. Fintech companies are using these tools to create innovative services.

MoneyWise

MoneyWise is a finance app that uses Open Banking APIs. It connects to users’ bank accounts and shows all transactions in one place. This helps people track spending, set budgets, and save money.

By using real-time data, MoneyWise gives users better control over their finances. It is a great example of how Open Banking improves personal finance management.

PayDirect

PayDirect is a payment app powered by Open Banking APIs. It lets users make fast payments directly from their bank accounts. No credit cards or slow transfers are needed.

This makes online shopping and money transfers easier. PayDirect shows how APIs can simplify payments while keeping them secure.

FinPoint

FinPoint is an account aggregation platform. It uses bank APIs to collect data from different financial accounts. Users can see their bank balances, loans, and investments in one dashboard.

This saves time and helps users manage money better. FinPoint proves how Open Banking makes financial planning simpler.

CreditSense

CreditSense uses Open Banking to offer fair loans. Instead of just checking credit scores, it analyzes real-time banking data. This helps approve loans faster and at better rates.

Borrowers with good financial habits get rewarded. CreditSense shows how APIs can make lending smarter and fairer.

Future Trends and Opportunities

The future of Open Banking and API economy looks bright. New technologies and trends will shape finance in exciting ways.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain can make Open Banking even more secure. It allows transparent and tamper-proof transactions. Smart contracts can automate payments and agreements without middlemen.

Banks are exploring blockchain for cross-border payments and identity verification. This could make financial services faster and cheaper.

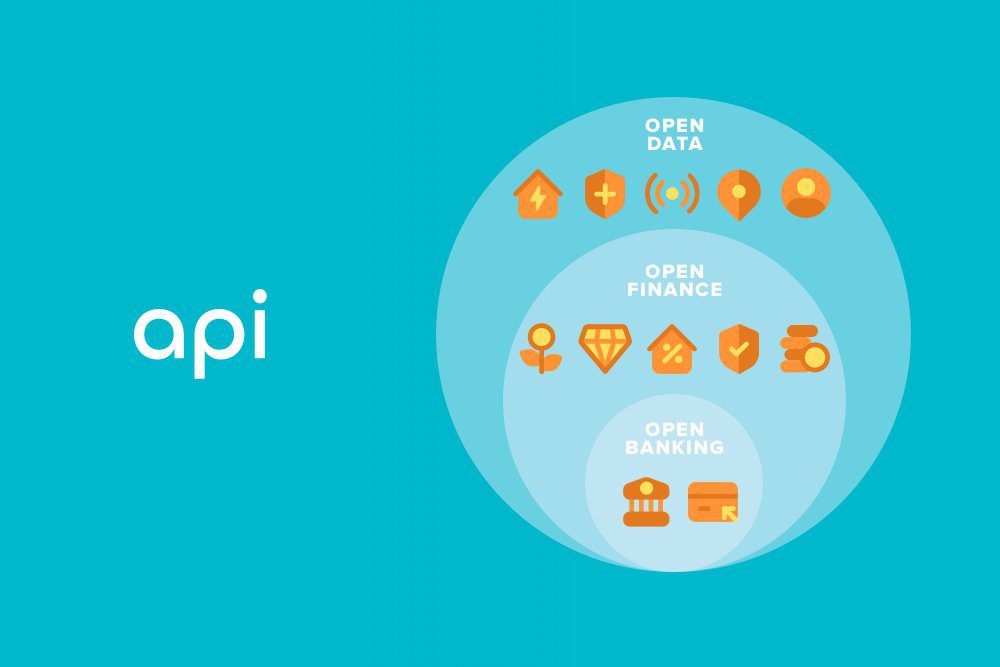

Open Finance and Expanded Data Access

Open Banking will grow into Open Finance. This means more than just bank data will be shared. Insurance, investments, and pensions could also be included.

Customers will get a full view of their finances in one place. This will help them make smarter money decisions.

Regulatory Inventions

New laws will support Open Banking growth. Governments want to encourage innovation while protecting consumers. Global standards could make cross-border banking easier.

Fintech companies will benefit from clearer rules. This will help them expand into new markets.

Hyper-Personalization

Banks will use AI and Open Banking data to offer personalized services. Apps will suggest products based on spending habits. Customers will get advice tailored to their needs.

This will make banking more helpful and user-friendly. People will feel more in control of their money.

Conclusion

Open Banking and API economy are changing finance for the better. They bring innovation, competition, and better services for customers. Banks and fintech companies must work together to overcome challenges.

The future holds even more opportunities. With new technologies and smarter regulations, Open Banking will keep growing. Customers will enjoy safer, faster, and more personalized financial services.

Ready to explore Open Banking and APIs for your business? Contact Progressive Robot now to discuss your options and drive innovation.