Building a Fintech MVP in Banking and Finance is a smart way for businesses to launch their products fast. An MVP, or Minimum Viable Product, helps companies test their ideas quickly while keeping costs low. Many banks and financial firms use this approach to stay ahead in a competitive market.

The banking sector is fast-paced, and delays can mean losing customers. By developing a Fintech MVP in Banking and Finance, businesses can gather user feedback early and improve their product over time. However, some traditional banks hesitate because they worry about security and regulations.

In this article, we will explore why a Fintech MVP in Banking and Finance works and how businesses can build one successfully. We will also discuss key features and challenges to help you make the right decisions for your project.

What Is a Minimum Viable Product (MVP)?

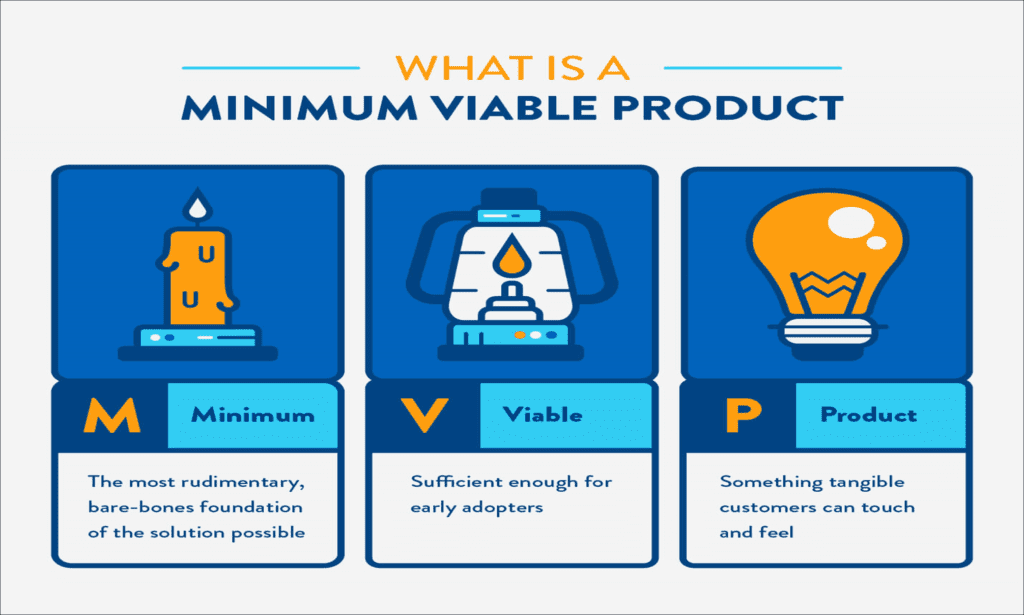

A Minimum Viable Product (MVP) is a basic version of a product with just enough features to satisfy early users. Companies use MVPs to test their ideas before investing in full development. This approach saves time and money while ensuring the final product meets customer needs.

Many people confuse MVPs with prototypes, but they are different. A prototype is a rough draft used to test technical feasibility. On the other hand, an MVP is a working product that users can interact with. It must be stable, secure, and useful enough to attract real customers.

A well-built Fintech MVP in Banking and Finance helps businesses validate their ideas quickly. It also provides valuable feedback for future updates. This way, companies can refine their product based on real user experiences instead of guesswork.

Challenges and Solutions in Developing a Fintech MVP in Banking

Building a Fintech MVP in Banking and Finance comes with unique challenges. Traditional banks often prefer slow, careful development to avoid risks. They worry about security, compliance, and accuracy in financial transactions. Rapid changes can be difficult in such a strict environment.

However, many modern financial companies have successfully used MVPs. For example, N26 used this approach to launch its digital banking services quickly. Similarly, Atomic Financial built a Fintech MVP in Banking and Finance during the pandemic to meet urgent market needs.

To overcome these challenges, businesses must choose the right development partner. A company like Progressive Robot, with deep FinTech experience, can ensure compliance and security. Additionally, selecting the right technology stack helps in scaling the product as the user base grows.

Key Features for a Fintech MVP in Banking

When building a Fintech MVP in Banking and Finance, businesses must focus on essential features first. Studying existing banking apps helps identify must-have functions. The goal is to create a product that users find valuable from day one.

For customers, key features include registration, KYC verification, and secure login. Users should also manage accounts, cards, and transactions easily. A transaction history feature helps them track spending and payments efficiently.

For the back office, features like customer management and KYC processing are crucial. Banks also need tools for handling transactions, fees, and exchange rates. Analytics and reporting help track performance, while role-based access ensures security.

After launching the MVP, businesses should collect feedback to decide on future updates. This way, they can add features that users truly need, making the product more competitive over time.

Conclusion

A Fintech MVP in Banking and Finance is a powerful tool for businesses that want to launch quickly. It helps test ideas, gather feedback, and improve products based on real user needs. While traditional banks may hesitate, modern financial firms have proven that MVPs work.

The key to success lies in choosing the right development partner. Progressive Robot has years of experience in FinTech and can help build a secure, scalable MVP. By focusing on essential features and user feedback, businesses can create a product that stands out in the market.

Want to test your Fintech idea quickly? Contact Progressive Robot today for a free MVP consultation! Their expertise ensures your product meets industry standards while staying ahead of competitors.

Building a Fintech MVP in Banking and Finance is not just about speed—it’s about smart, user-driven development. Start small, grow fast, and succeed in the competitive financial world.